caused by U.S. shale production. OPEC balked at cutting supplies to shore up prices at its late-November meeting and recent activity suggests it intends to stand by its decision, even if prices fall as low as $40 per barrel. They intend to wait at least three months before considering an emergency meeting. The minister of energy from the United Arab Emirates, said "we're not targeting a price; the market will stabilize itself."

Here are 4 charts (and some brief comments) that help to provide some perspective on the global issues surrounding the drop in oil prices.

The declining price of oil has wreaked havoc on global investment markets—while consumer confidence has been the benefactor. It seems evident that the drop in price is largely due to 2 factors as explained in these 2 successive charts.

Global supply has been buoyed by a significant increase in US oil production over the past 5 years. US shale drilling projects have increased 47.5% from 2008.

The supply/demand curve for oil will certainly be affected a potential drop in consumption. Future oil demand will likely decrease with a proliferation of alternative and/or renewable energy sources. There is a question as to whether or not cheap oil will make other energy sources less appealing.

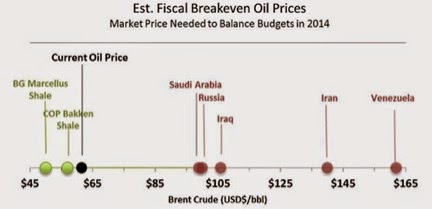

The last chart perhaps is most illustrative of the affect of oil prices on resource-driven economies. Russia’s economy has already taken a big hit, and other emerging economies could follow.

The drop in oil prices has caused volatility on investment markets, and I would expect that to

The drop in oil prices has caused volatility on investment markets, and I would expect that to continue. This could potentially slow the Federal Reserve’s move to raise rates in 2015. Though oil is only part of the economic jigsaw, it is a LARGE piece of the puzzle.

Sources: Energy Information Administration; BP Statistical Review of World Energy; Business Insider, Deutsche Bank Research, Wall Street Journal, Citibank Researc