U.S. equities bounced back twice last week after the S&P 500 had approached its August 25th low of 1,867. The benchmark index had fallen as much as 2.6% last Monday after Glencore Plc, one of the world's largest commodities export firm, plunged 28% on a selloff in commodities. Meanwhile, on Friday, stocks recovered from a morning retreat surrounding a very disappointing jobs report. Labor Department officials said the economy added just 142,000 new jobs last month, well below economists' consensus forecast for 203,000. Downward revisions in August and July subtracted 59,000 jobs. And while the unemployment rate held steady at 5.1%, it did so because the labor force contracted by 350,000. The jobs data renewed concerns over slowing global growth, yet investors realized the disappointment will likely cause the Federal Reserve to once again delay raising interest rates.

In other key economic data last week, factory orders fell by 1.7% in August to $473.0B, missing projections for a 0.2% gain. On a brighter note, Congress passed temporary budget legislation to fund the federal government through December 11th, thereby avoiding a shutdown of non-essential operations. Meanwhile, Treasury Secretary Jack Lew told Congress that the government will exhaust its borrowing authority a month sooner than expected, and would likely occur on or near November 5th. He asked Congress to raise the debt ceiling beyond the current level of $18.1 trillion.

For the week, the S&P 500 advanced +1.10%; the Dow Industrials added +0.97%; and the MSCI EAFE (developed international) gained +0.66%.

What We're Reading

Effects from a Phantom Rate Hike -- PIMCO.com

Merger Flurry Trend Nears Record Premium -- NY Times

Worst Global Stock Performance Since 3Q 2011 -- Wall Street Journal

Disappointing September Payrolls Report

Odds for 2015 Fed Rate Hike Goes Down...a Lot

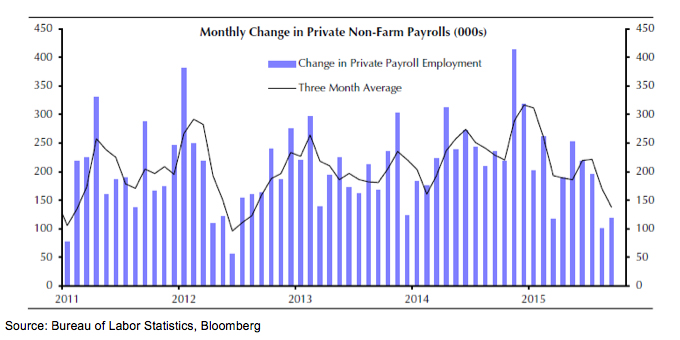

Payroll employment increased by just 142,000 last month (203,000 was forecast), and August's total of 173,000 was revised lower to 136,000. As the above chart illustrates private-sector payrolls (i.e. non-government jobs) increased by just 118,000 in September and were revised to 100,000 for August. The last time private-sector job gains were this low was back in mid-2012. And while back then, the Federal Reserve had responded by launching a third round of quantitative easing (QE3), no such "QE4" response is even being contemplated today. However, this does mean that the Fed would be very hard pressed to raise interest rates with these low jobs numbers. Aside from this report and negative strong US dollar effects that are slowing manufacturing, most other U.S. economic measures are quite positive, especially improvements in consumer spending.

Articles chosen and summarized by the Tower Square Investment Management team. Tower Square Investment Management provides investment management and advisory services to a number of programs sponsored by First Allied Securities and First Allied Advisory Services. Tower Square Investment Management individuals who provide investment management services are not associated persons with any broker-dealer. International investing involves additional risk, including currency fluctuations, political or economic conditions affecting the foreign country, and differences in accounting standards and foreign regulations. These risks are magnified in emerging markets. Investing in companies involved in one specified sector may be more risky and volatile than an investment with greater diversification.