A Look at Baseline Financial Health Ratios

In this month’s 8 Wealth Issues blog, I thought I would address the concept of what our practice refers to as “Fiscal Fitness.” New clients to our practice sometimes do not understand what I am referring to, but this is the foundation for sound financial planning. This involves capturing an accurate picture of your current financial condition—documenting what all of your assets are worth, less any liabilities; as well as building a cash-flow model that is true to your income and spending habits.

Fiscal fitness goes beyond this as well. It includes being organized with financial documents, and managing your wealth so that you can feel confident making future financial decisions. Often helping clients make financial decisions comes in “stress-testing” the impact of those decisions within your current financial plan.

Baseline financial health, however, can be brought back to 4 ratios. These are:

Monthly Surplus/Monthly Income

After you pay all of your monthly obligations, how much money do you have left? This is your monthly surplus and if you divide this amount by your total monthly income, you’ll get an idea of how well you manage your finances and also, an ideal percentage of that income you can put away for savings. When calculating your monthly obligations, be sure to include everything — all of your bills, credit card bills, your house payment, groceries, and even your magazine subscriptions.

It is important to note that you should add back in any 401k contributions into your monthly income, as this is periodic savings mechanism and that is exactly the ratio we are looking to measure here. This ratio can identify whether or not you could be putting more toward tax advantaged retirement savings.

Cash and Liquid Assets/Monthly Expenses

For this ratio, you want to add in all of your cash assets, like cash on hand, cash in the bank, money market account balances, and money you have in CDs (do not include cash in retirement accounts). If you divide that total by the total amount of all of your monthly expenses, you’ll get an idea of how long you can sustain your household in the event of an emergency situation, like illness or job loss. For self employed people or single income households, this can be a crucial ratio to be mindful of.

Of all the items I look at when assessing a clients Fiscal Fitness, it is the presence of an adequate emergency fund that is most often missing. Not having this ratio in good health could cause you to have to invade retirement savings in the event of loss of income—which in turn may cause tax headaches and penalties.

Cash and Liquid Assets/Net Worth

Your net worth is the difference between your assets and your debt. To calculate your net worth, add up the value of all of your assets. This includes everything, ranging from the value of your home, to the estimated value of your furniture, to all of your cash and cash assets. Subtract your debts (your credit card balances, mortgage, etc.) from this amount. There are also some online net worth calculators you can use to walk you through the process.

Once you’ve determine your net worth, divide your net worth by all of your cash and liquid assets (your bank account balances, CDs, money market accounts, etc.). This will give you the percentage portion of your net worth that is held in liquid form. Too high of a ratio means you could have too much cash at hand and therefore your money is likely not working for you adequately. Conversely, a common mistake I see is people reaching for growth by putting short term money in risk-based investments. Be mindful of time horizon.

Monthly Debt/Monthly Income

This is your debt to income ratio and it helps determine how much of a lending risk you are. Banks use this ratio as a baseline for determining loan approvals & mortgages. The lower your debt-to-income ratio, the better chance you have of receiving credit from lenders in most cases. Ideally, 36 percent is the highest debt-to-income percentage you should have. You can calculate this ratio on your own by dividing your total monthly debt (credit card payments, student loans, mortgage payment, etc.) by your monthly income.

These ratios can help you set a good baseline for financial health and making sound financial decisions. Please be sure to contact our practice if you would like help in looking at all the aspects of Fiscal Fitness or any of the other 8 Wealth Issues we help with tackling. The beginning of a new year is a great time to turn over a new financial leaf.

Happy Holidays.

Citations.

Personal Finance Cheat Sheet – “How Financially Healthy Are You? Find Out Using 4 Ratios”

This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

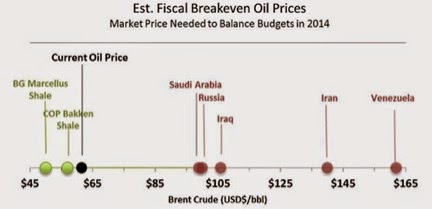

The drop in oil prices has caused volatility on investment markets, and I would expect that to

The drop in oil prices has caused volatility on investment markets, and I would expect that to